This article will go through what a Cash Reconciliation is in Blackpurl as well as explain how to process a Cash Reconciliation

There is also a section on what User Permissions are required in order to process a Cash Reconciliation in Blackpurl

What is a Cash Reconciliation

The Cash Reconciliation is a tool that will help you compare the Payment Methods processed in Blackpurl totals vs the actual cash and credit/debit receipts for a particular date range

This tool will assist the Dealership in reconciling the days taking (for any particular date) and noting any variances

We would recommend:

- that at the close of business every day you balance out your Point of Sale Cash Drawers (Tills)

This will ensure that your Cash Drawers are correct and you are not over or under in your till etc

- to then finalise the process we would recommend that you do a Cash Reconciliation for each days taking and batch each days banking up as separately bank deposits

Please note:

- Cash Reconciliations can be done at any time ie the same day / the next day / in a weeks time etc

- If you take advantage of the feature of back dating Customer Order Deposits / Payments then the backdated payment will show up on the Cash Reconciliation on the backdated date

However if you try and backdate a Customer Order Deposit or Payment to a date that has already been reconciled in the Cash Reconciliation, the system will NOT allow you to select that date.

How to process a Cash Reconciliation

- From the Blackpurl Header > click

- Then using the Calendar > click on the date you are wanting to reconcile

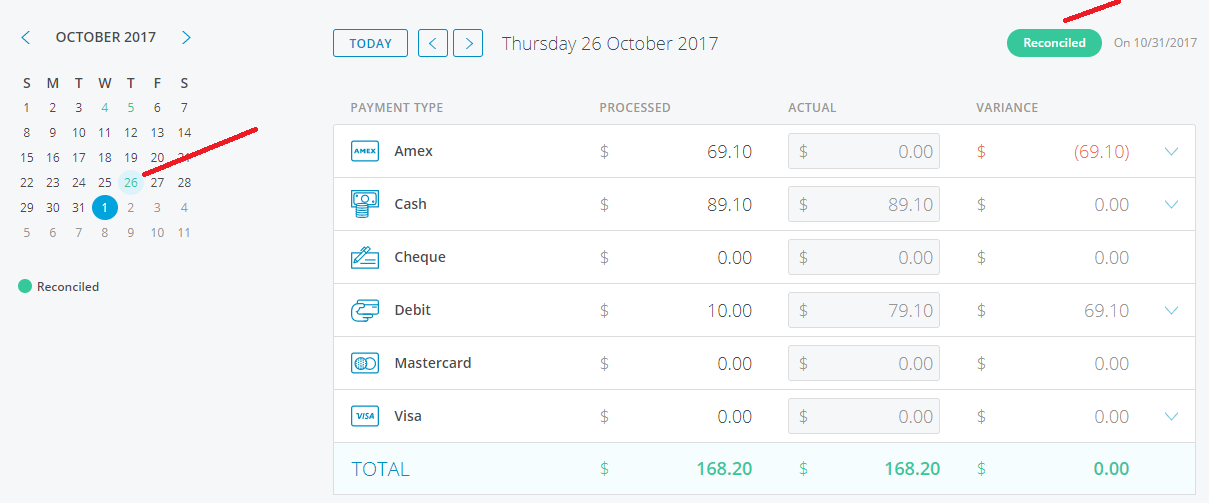

For Dealerships that only have one single Cash Drawer:

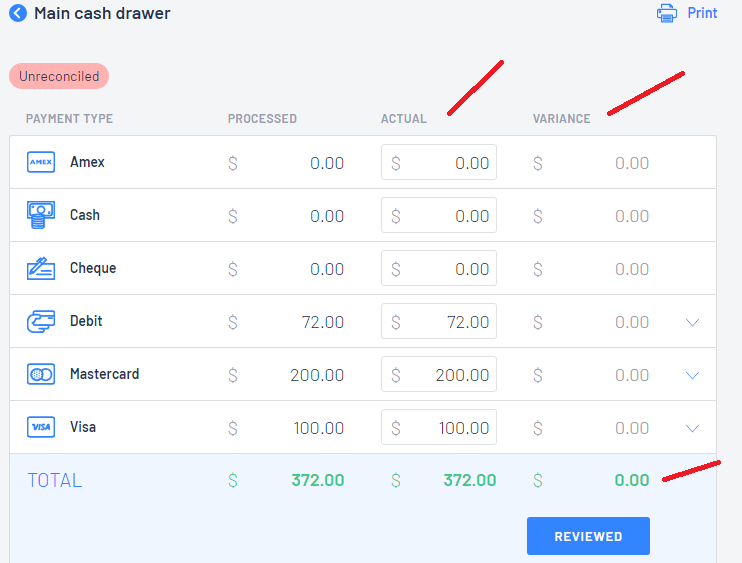

- Your screen will look similar to this:

| Payment Type | These are already setup in Blackpurl These are the Payment Method options on how Customers pay their Invoices or Deposit ie by cash / Visa etc |

| Processed | This is how much has been processed through Blackpurl against each Payment Type |

| Actual | This is a manually entered field Users will be required to enter in an actual amount against each Payment Type (even if it is zero) |

| Variance | If there is a variance between the Processed amount and the Actual amount, it will list in this column |

- Work your way down the Actual column entering the actual figures for each Payment Type making sure there is a figure in each field (even if it is zero)

Tip: To see what transactions make up the Processed amount for each Payment Type, click onon the relevant Payment Type line and it will list the transactions

Any variances can then be followed up by the Dealership as to why the total that Blackpurl says that you are banking for that day, does not balance out to the manual figures you have just entered in

- Once you are happy with your Cash Drawer, click on

Then click on and depending on what your Blackpurl is setup with, will depend on whether you do Option 1 or 2 below

and depending on what your Blackpurl is setup with, will depend on whether you do Option 1 or 2 below

Option 1

New Dealerships with Blackpurl and / or a Dealership that has been through the Payment Accounting Method conversion (as per this article - Payment Accounting Method Conversion) then this option will be for you

To accept this journal entries click on

Option 2

If your Dealership has elected not to use the Payment Accounting Method then no journal entry option will be available to you and you will need to confirm by clicking  to close out the Cash Reconciliation

to close out the Cash Reconciliation

- Blackpurl will change the Cash Reconciliation status to Reconciled and it will show up as green in the calendar.

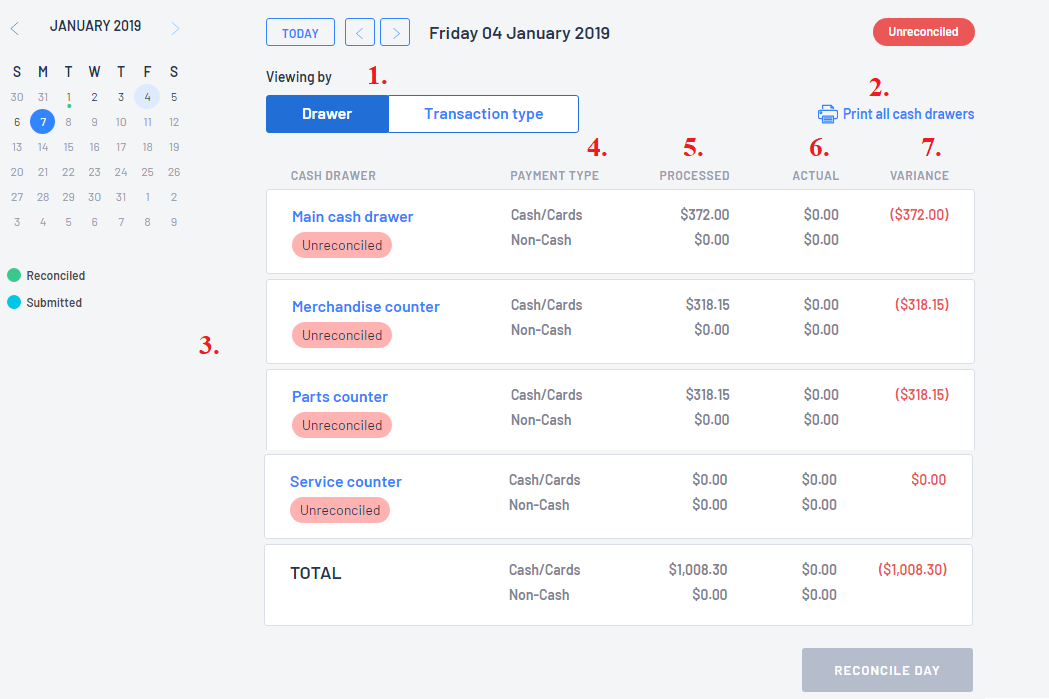

For Dealerships that have multiple Cash Drawers

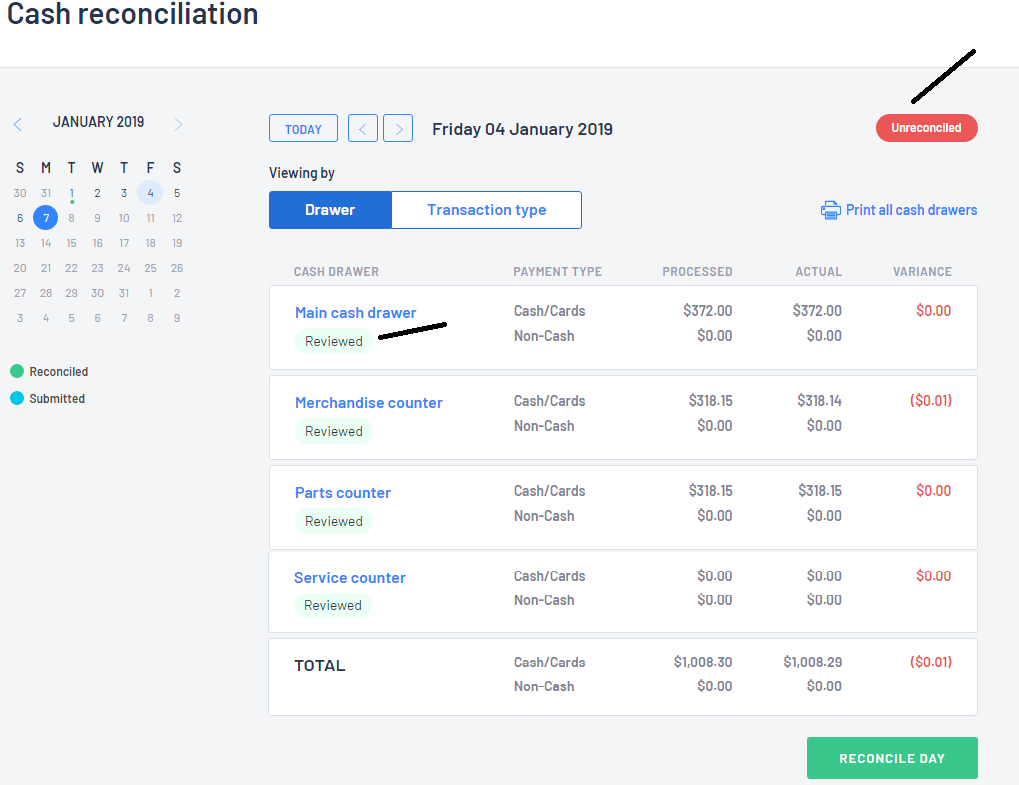

- For Dealerships with multiple Cash Drawers, the Cash Reconciliation section will list similar to this:

| 1. | Viewing By | User can view by Drawer or by Transaction Type They will just need to click on their selected view |

| 2. | Print all Cash Drawers | This gives the User the option to print |

| 3. | Cash Drawers | If User selects to View by Drawer - the Drawers will list down If User selects to View by Transaction Type - then the Transaction Types will list |

| 4. | Payment Type | It will give a summary of the Payment Type ie Cash/Card and Non Cash etc |

| 5. | Processed | This is how much Blackpurl is indicating has been processed against that Payment Type |

| 6. | Actual | This is a manually entered field and Users will be required to enter in the actual amount (even if it is zero) |

| 7. | Variance | If there is a variance between the Processed amount and the Actual amount, it will list in this column |

- Each Cash Drawer will need to be reconciled

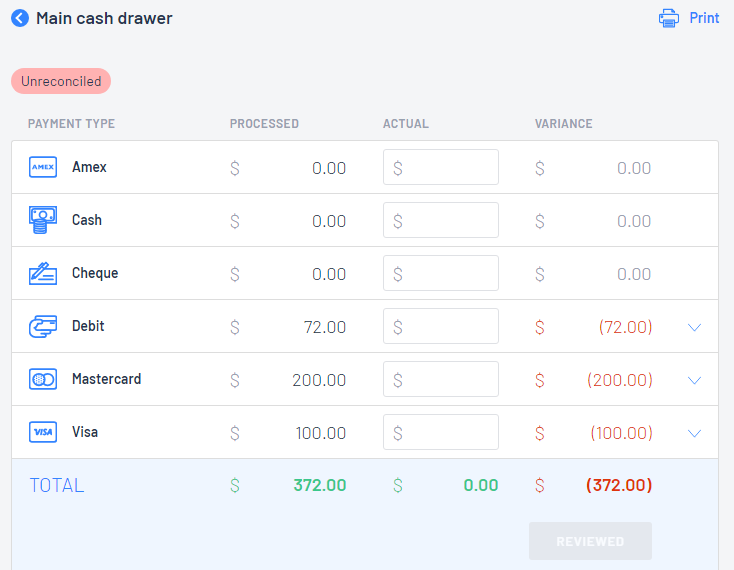

To start click on the Cash Drawer that you wish to reconcile to open up the Transaction Type section in full

- Then work your way down the Actual column entering the actual figures for each Payment Type making sure there is a figure in each field (even if it is zero)

Tip: To see what transactions make up the Processed amount for each Payment Type, click onon the relevant Payment Type line and it will list the transactions

Any variances can then be followed up by the Dealership as to why the total that Blackpurl says that you are banking for that day, does not balance out to the manual figures you have just entered in

- Click on

to go back to the main Cash Reconciliation screen and complete Steps 2 and 3 for all Cash Drawers until all Cash Drawers have the status Reviewed

to go back to the main Cash Reconciliation screen and complete Steps 2 and 3 for all Cash Drawers until all Cash Drawers have the status Reviewed

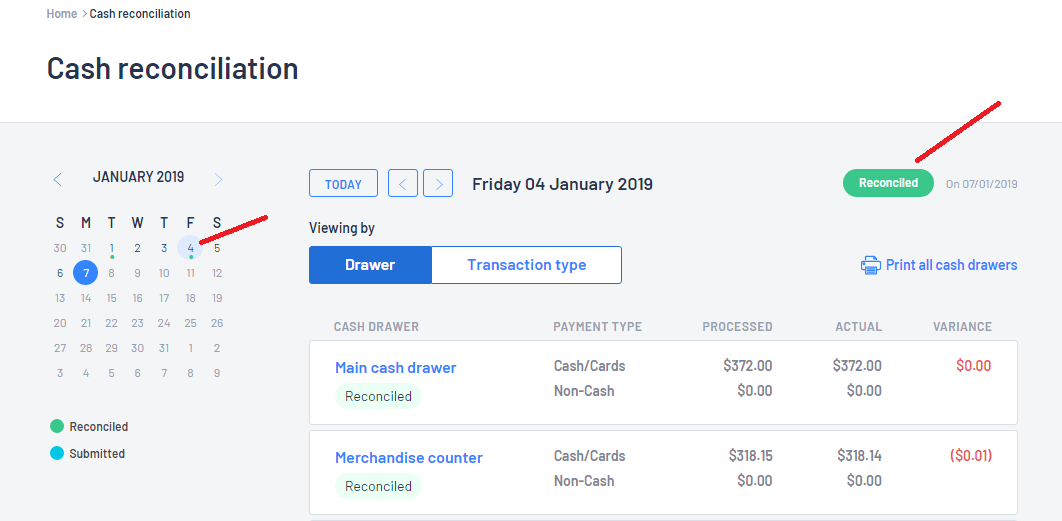

- Once all the Cash Drawers are in Reviewed Status, it is time to reconcile the day

and depending on what your Blackpurl is setup with, will depend on whether you do Option 1 or 2 below

Option 1

To accept this journal entries click on

Option 2

If your Dealership has elected not to use the Payment Accounting Method then no journal entry option will be available to you and you will need to confirm by clicking  to close out the Cash Reconciliation

to close out the Cash Reconciliation

6. Blackpurl will change the status of the Cash Reconciliation and all the Cash Drawers to Reconciled and it will

show up as with a green mark in the calendar.

User Permissions - Cash Reconciliation / Cash Drawers:

There are User Permissions that control who has access to Cash Reconciliations etc - System Settings > User Permissions

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article