This article is regarding all things Tax for our Canadian Dealerships

Basically anything to do with sales tax or purchase tax is in this article from setup / editing / reporting / changing tax on Customer Orders etc will be covered in this article

As taxes are very important, if at any time you are unsure, PLEASE reach out to Blackpurl Support and they can give you a call to go through any tax concerns you have

Summary

- Both QuickBooks Online and Xero do not allow third parties (like Blackpurl) to integrate directly to any of their Tax General Ledgers or Tax defaults

- As this is the case, at Activation, your Dealership would have been setup with new BP Tax Collected and BP Tax Paid General Ledgers in your Accounting package which would that then been subsequently mapped to in your Blackpurl

- When a Customer Order Invoice and / or a Vendor Invoice with tax, integrates from Blackpurl to Xero / QuickBooks Online, the tax will show in Xero / QuickBooks Online as a line item pointed to the relevant BP Tax Collected or BP Tax Paid General Ledgers

- When reporting on your taxes, instead of using Xero / QuickBooks Online to pull the relevant reports, you would use Blackpurl

- Then when accounting to the relevant government authority, you will need to allocate 'payment' to the BP Tax Collected / Tax Paid General Ledgers in your accounting package

Tax Settings

All of the Tax settings for your Dealership, are under the Blackpurl Header - Other Tools > Tax Activity & Settings

For users to have access to this section, they need to have the User Permission - Tax Management

Once the user has the relevant User Permission, then the user will be able to access the Tax Activity & Settings section from the Blackpurl Header

Tax Activity & Settings section

Let us cover off this section of Blackpurl

- Once you have the correct permission, from the Blackpurl Header > click

and then select

and then select

- Once you have logged into the Tax activity & settings screen, you will notice 4 tabs:

ACTIVITY

SETTINGS

TAX CODES

MANUAL TAX RATES

We are going to go through each tab separately below

A. Activity

Under Activity is where you can run your Tax Activity report (also known as the Tax Detail Report) - just add your From and To date range > click

By default, the report will automatically Exclude Internal Invoices but if you want to include Internal Invoices, uncheck the relevant checkbox  and then just run the report again

and then just run the report again

This Tax Activity report will then summarise:

- your Tax Collected on Sales as well as list the relevant tax names that make up that section

- your Tax Paid on Purchases as well as list the relevant tax names that make up that section

Our example below is for our training environment that will show you how things list - remember that your taxes will be specific to your own Dealership:

- We ran the Tax Activity report for the period 1st April 2024 to 30th April 2024 (excluding Internal Invoices) and the search results are as follows:

- Let's go through the search result screen

Tax Collected on Sales

| 1. | Tax Name - This will list both the Totals of all the Tax Collected on Sales together with a list of Sales Taxes that make up this total |

| 2. | Transaction Count - this will list how many transactions make up this tax |

| 3. | Taxable Amount - this will list the taxable amount that makes up this tax |

| 4. | Tax Amount - this will list the tax that was calculated |

| 5. | Non Taxable Amount - this will list if there was any non taxable amount |

| 6. | TOTAL: Tax Collected on Sales - this is the total of all your Sales Taxes |

| 7. | This will list the total tax amount that has been calculated for all your Sales Taxes |

| 8. | It will list each of your Sales Taxes and in this example, this dealership only has one Tax Collected on Sales ie bp gst collected If you have multiple Sales Taxes then it will list all of them individually |

| 9. | The total transactions that make up this Sales Tax |

| 10. | The total taxable amount for this Sales Tax |

| 11. | The total tax amount taken for this Sales Tax |

| 12. | If there are any non-taxable taxes taken for this Sales Tax |

Tax Paid on Purchases

| 13. | Tax Name - This will list both the Totals of all the Tax Paid on Purchases together with a list of Purchase Taxes that make up this total |

| 14. | Transaction Count - this will list how many transactions make up this tax |

| 15. | Taxable Amount - this will list the taxable amount that makes up this tax |

| 16. | Tax Amount - this will list the tax that was calculated |

| 17. | Non Taxable Amount - this will list if there was any non taxable amount |

| 18. | TOTAL: Tax Paid on Purchases - this is the total of all your Purchase Taxes |

| 19. | This will list the total tax amount that has been calculated for all your Purchase Taxes |

| 20. | It will list each of your Purchase Taxes and in this example, this dealership only has one Tax Paid on Purchases ie gst payable If you have multiple Purchase Taxes then it will list all of them individually |

| 21. | The total transactions that make up this Purchase Tax |

| 22. | The total taxable amount for this Purchase Tax |

| 23. | The total tax amount taken for this Purchase Tax |

| 24. | If there is any non-taxable taxes taken for this Purchase Tax |

Remember at any time you can click on  and when you do one of these actions, it will print or export both the summary as well as what transactions make up the section (depending on what screen you are on)

and when you do one of these actions, it will print or export both the summary as well as what transactions make up the section (depending on what screen you are on)

Should you wish to see what transactions make up the Sales or Purchase Tax - simply click on the Tax Name

In our example below we want to know what transactions make up the bp gst collected tax so we clicked on that tax name

Then it will provide you with a list of transactions which you can view on the screen or

To go back to the home Activity screen search result, click

B. Settings

This section is broken up into different areas:

- General Settings

- Account Type / Tax Exemptions

- Automatic Tax Rate Controls

- Accrued Tax Controls

- Default Applicable Tax Codes

General Settings

| 25. | Tax ID on documents - If your government requires you to have your Tax ID on your Customer Order documentation ie Invoice, then this is where you would record the Dealerships Tax ID number |

| 26. | Prices include sales tax - this is just an indicator of whether the Prices in your Blackpurl include sales Tax or not - our Canadian Dealerships are not required to have their prices to customers include sales tax so this indicator will say No |

| 27. | Trade tax credit cannot exceed unit tax - This means that when you take a trade-in on a Unit Deal, the trade-in tax credit cannot exceed the amount of the unit tax payable For further information, please review our article - Trade In Tax Credit cannot exceed Unit Tax |

| 28. | Unit options that are taxed like the unit - you get to select what options are taxed at the same rate as the Unit sale Simply click on the field and then it will give you the options available for you to make your selections as to which options are to be taxed at the same rate as the Unit  |

| 29. | Group Individual taxes on sales Enable this toggle If the Dealership has multiple taxes (PST / GST etc) but the dealership only wants the tax to show up on the customer end documents on a Customer Order grouped as as say Sales Tax, you can enable this toggle to do this Once this toggle is enabled, the Dealership will then have the option to indicate what name they want to group all the taxes as ie Sales Tax  Not enable this toggle If you select not to enable this toggle, then each tax will list separately on the customer end document on a Customer Order |

| 30. | Group Individual taxes on purchases Enable this toggle If the Dealership has multiple purchase taxes but the dealership only wants the tax to show up grouped as as say Purchase Tax, you can enable this toggle to do this Once this toggle is enabled, the Dealership will then have the option to indicate what name they want to group all the taxes as ie Purchase Tax  Not enable this toggle If you select not to enable this toggle, then each purchase tax will list separately |

Account Types / Tax Exemptions

This will list the Account Types / Tax exemptions currently set in your Blackpurl

This is the relevant article going through Account Type and how to create new ones etc - Setting up Account Types (includes the control of tax exemptions)

Accrued Tax Controls

If your Dealership requires this setup, please reach out to Blackpurl Support

Default applicable tax codes

These are the default applicable Tax Codes that have been set in your Blackpurl

These are usually setup for your Dealership during Activations

If you need to change the defaults, simply click into the relevant field > the drop-down will give you the options available for selection

If you don't understand what you need or understand the ramifications of changing these defaults, please reach out to Blackpurl Support for assistance

D. Manual Tax Rates

We are going out of order and going to go through D. Manual Tax Rates first as it will help to then explain C. Tax Codes

This section is broken up into Sales transaction manual tax rates and Purchase transaction manual tax rates and the title explains exactly what they are:

- Sales transaction manual tax rates - These are tax rates that are only applicable for sale transactions ie Part Sales / Unit Deals / Service Jobs etc

- Purchase transaction manual tax rates - These are tax rates that are only applicable for purchase transactions ie Vendor Invoices for Parts and Units etc

What are tax rates?

For our USA Dealership - it can be quite complicated with some USA states having numerous tax rates that may need to be combined together as a Tax Code

Your tax rates are usually setup during discussion with your Activation team but it may be necessary for you to setup a new tax rates

To create a new rate > click on

New selling tax rate window will look like this:

B. Category - Allocate the new Tax Rate a Category (accounting integration)

C. Type - There are three options:

Fixed - the tax rate is a fixed or set rate. For example, the tax rate is fixed at 10% across the board

Escalating - the tax rate increases as the taxable amount increases. For example the first $5000 the tax rate is 10% / for the next $5000 the tax rate is 12% etc

Tiered - the tax rates would be setup based on the total transactional amount. For example - normal tax rate is 7% but will change to 7.5% once the order is over $3000

D. Rate - Type in the percentage of the rate

E. Forms label - When this tax prints on a Customer Invoice etc, what do you want it to read?

F. Minimum tax - This field comes into play if you select the Type: Escalating or Tiered in C.

G. Maximum tax - This field comes into play if you select the Type: Escalating or Tiered in C.

H. SAVE - Once you have completed the New Selling Tax Rate, don't forget to click on SAVE

on the relevant line item and the system will open up the Tax Rate for you to make the amendments

on the relevant line item and the system will open up the Tax Rate for you to make the amendmentsTo delete a Tax Rates > click on

on the relevant line item and the user will be asked to confirm the deletion

on the relevant line item and the user will be asked to confirm the deletionC. Tax Codes

Tax Codes will allow you to join two or more tax rates together to make up the relevant taxes applicable

For example, a customer is in a location that the Dealership needs to be charged a State Tax of 5% and a GST tax of 8% when this customer purchases from the Dealership

The Dealership would set both of these as Tax Rates (using D. Manual Tax Rates) and then use Tax Codes to join the relevant tax rates together as a Tax Code (making sure the total correct tax is calculated and charged to the customer)

Tax Codes are split into two sections:

- Tax Codes for sales transactions

These are Tax Codes that are only applicable for sale transactions ie Part Sales / Unit Deals etc - Tax Codes for purchase transactionsThese are Tax Codes that are only applicable for purchase transactions ie Vendor Invoices etc

Your Tax Codes are usually setup during discussion with your Activation team but it may be necessary for you to setup a new Tax Code

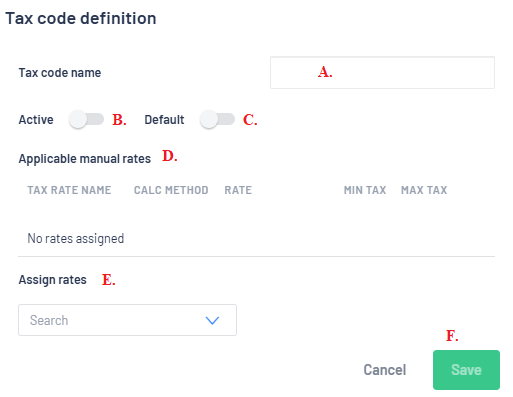

To create a new Tax Code > click on  as a New selling Tax Code or New Purchase Tax Code window

as a New selling Tax Code or New Purchase Tax Code window

For example - New selling Tax Code window looks like this:

B. Active - indicate by moving the toggle if this Tax Code is to be active and available for selection

D. Applicable manual rates - add in any Applicable manual rates

F.  when you have finished the setup

when you have finished the setup

on the relevant line item and user will be asked to confirm the deletion

on the relevant line item and user will be asked to confirm the deletion

To review a Tax Code with a view to editing, click on  on the relevant Tax Code

on the relevant Tax Code

Customer Orders

There are sections in a Customer Order - Unit Deals / Parts & Accessories / Service Jobs that will give you what tax options are available to you

Unit Deal section

Each time you add a new Unit to the Unit Deal section, the default tax setting will automatically load

The User can leave it as is and it will default to the default tax (usually based on the Dealership's address) but there are other taxation options available

Under the Unit Deal Summary section:

This will list any Sales Tax that is attached to the whole of the Unit Deal - remember that a Unit Deal may have multiple units being purchased

If you wish to see the breakup of the taxes, click on  Example:

Example:

Under the individual Unit Sales sections, you do have the option of changing how tax is calculated

- If you need another applicable tax, simply click on the dropdown in the field Applicable tax A and then select the relevant tax

- You can choose for your options not to be taxed the same way (default) by clicking on the section B and then unticking those items that should not be taxed in the same way as your unit

Parts & Accessories section

Each time you add a Parts & Accessories section, the default taxes will automatically load

Under the Parts & Accessories Summary section:

- Sales Taxes

This will list any Sales Taxes that are attached to the Parts & Accessories but if you need to see the breakup of what taxes, click on

Example:

- Override how taxes are calculated?

To override the default taxes, simply enable the toggle and then select the applicable tax

Then you will need to select which Item Types that you want to use this tax for:

Service Job section

Each time you add a new Service Job section, the default taxes will automatically load

Under the Service Job Summary section:

- Sales Taxes

This will list any Sales Taxes that are attached to all the Service Jobs on this Customer Order but if you need to see the breakup of what taxes, click on

Example:

- Override how taxes are calculated?

To override the default taxes, simply enable the toggle and then select the applicable tax

Then you will need to select which Item Types that you want to use this tax for:

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article